In This Quarterly Report, Provided Exclusively to Rock Products, Capstone Headwaters Provides Insight Into Merger and Acquisitions (M&A), Capital Markets Trends, Aggregate Production and Pricing Through Q4 2018.

By Darin Good and Brian Krehbiel

Capstone Headwaters’ Building Products & Construction Services Team advises industry business owners, entrepreneurs, executives and investors in the areas of M&A, capital raising and various special situations advisory. Due to our extensive background and laser focus within the industry, Capstone Headwaters is uniquely qualified and has an unparalleled track record of successfully representing building products and construction companies.

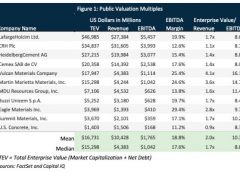

PUBLIC VALUATION COMMENTARY

Capstone Headwaters’ Aggregates Materials Index (Figure 1) indicates that average public company EBITDA multiples declined from 12.9x at the end of Q3 2018 to 10.3x at the end of Q4 2018.

M&A OVERVIEW

Preliminary estimates of total acquisition activity in Q4 2018 demonstrated a decrease of 20 percent compared to the same period in 2017 in terms of the number of aggregates related transactions completed (24) in the US and Canada. Despite this quarterly decline, total transaction volume in 2018 outpaced 2017 activity, increasing 4.2 percent year-over-year. Healthy demand in the Aggregates industry is expected to persist in spite of proposed discretionary budget cuts for the Department of Transportation (DoT) for 2020.1 The Federal Government has called upon increased infrastructure investments by state, local, and private parties, incentivizing them through; a fully funded Highway Trust Fund; a $1 billion commitment to the BUILD grant program which supports innovative projects that enhance quality of life and economic competitiveness; and a $2 billion allocation to the Infrastructure to Building America competitive program. States including Missouri, Alabama, Ohio and Michigan have also taken steps toward strengthening infrastructure investments by raising fuel taxes to support road building and maintenance.

PRIVATE EQUITY TRANSACTION ACTIVITY & VALUATIONS

GF Data Resources, a provider of detailed information on business transactions ranging in size from $10 to $250 million, provides quarterly data from over 200 private equity firm contributors on the number of completed transactions. Figure 4 provides the number of completed transactions from GF Data contributors, the average Total Enterprise Value (TEV)/EBITDA multiples, and the average amount of debt utilized in the transaction computed as a multiple of EBITDA. The data, although not industry specific, showed that the number of transactions declined to historical levels while average EBITDA multiples increased and total debt and senior debt multiples remained relatively flat.

COMPANY SPOTLIGHT![]() Eagle Materials’ revenues declined 7 percent in Q4 on a year-over-year basis, yet increased 0.6 percent through the nine months ending Dec. 31, 2018.2 The comparability of their performance was affected by two non-recurring items (tax benefit of ~$61 million and a litigation settlement expense of $39 million). In Q4, performance was impacted by: improved operating margins in the Wallboard business; higher cement prices and volumes; and a fall in Concrete and Aggregates revenues which reflected a lower sales volume that was only partially offset by improved concrete pricing and heavier than typical rainfall in Q4 2018.

Eagle Materials’ revenues declined 7 percent in Q4 on a year-over-year basis, yet increased 0.6 percent through the nine months ending Dec. 31, 2018.2 The comparability of their performance was affected by two non-recurring items (tax benefit of ~$61 million and a litigation settlement expense of $39 million). In Q4, performance was impacted by: improved operating margins in the Wallboard business; higher cement prices and volumes; and a fall in Concrete and Aggregates revenues which reflected a lower sales volume that was only partially offset by improved concrete pricing and heavier than typical rainfall in Q4 2018.

Commenting on Q4 results, Dave Powers, CEO, said in a press release, “Adjusting for the effects of unusual weather trends during calendar 2018 and a shift in the timing of wallboard price increases and related buying activity, we estimate that the overall market demand for our building materials, notably cement and wallboard, remained in positive territory in calendar 2018, with growth rates in the low single digits. The outlook for calendar 2019 continues to be positive as the basic underlying fundamentals of low unemployment, low interest rates, and higher wages remain favorable.”

This positive momentum is expected to continue in Q1 2019, supported by the following underlying market trends:

• Demand resiliency in operating markets.

• High capacity utilization in cement and wallboard plants which, along with sustained demand and low import threats, creates a favorable environment for cement and wallboard products.

• Relatively restrained overall cost pressures for inputs.

US Concrete reported record quarterly revenues, increasing 8.4 percent year-over-year to $370.1 million in Q4 2018.3 Strong quarterly performance was attributed to increases in ready-mix revenues (+6 percent) and volume (+3 percent) as well as increases in aggregates revenues (+60 percent) and volume (+41 percent). Quarterly adjusted EBITDA rose 6 percent to $46.2 million. The robust quarterly performance was representative of their full-year results, increasing total revenues and EBITDA by 12.8 percent and 0.7 percent year-over-year, respectively.

US Concrete reported record quarterly revenues, increasing 8.4 percent year-over-year to $370.1 million in Q4 2018.3 Strong quarterly performance was attributed to increases in ready-mix revenues (+6 percent) and volume (+3 percent) as well as increases in aggregates revenues (+60 percent) and volume (+41 percent). Quarterly adjusted EBITDA rose 6 percent to $46.2 million. The robust quarterly performance was representative of their full-year results, increasing total revenues and EBITDA by 12.8 percent and 0.7 percent year-over-year, respectively.

William J. Sandbrook, chairman, president and CEO, said in a press release, “Our full-year results include record highs in aggregate products and ready-mixed concrete volumes and revenues. This growth was aided by contributions from our recent acquisitions, most notably Polaris Materials Corporation. As we have indicated, Polaris continues to provide the performance we expected, although on a much more accelerated pace than we originally expected, and is contributing meaningfully to the increases in our aggregates segment.”

Based on the positive momentum and strong Q4 performance, revenue guidance for 2019 has been revised upward and is expected to fall between $1.5 and $1.65 billion with adjusted EBITDA of approximately $205 to $225 million.

NOTABLE TRANSACTIONS

|

|

|

|

Brickworks Limited to acquire Glen-Gery Corp.

(November 2018, $110 Million)

Brickworks (ASX:BKW) has entered into a binding agreement to acquire Glen-Gery from Ibstock (LSE:IBST) at an enterprise value of $110 million, equating to 8.5x EBITDA.4 Ibstock, a UK-based leading manufacturer of clay bricks and concrete products, has decided to divest Glen-Gery to focus on its core markets in the UK.

Founded in 1890 and headquartered in Pennsylvania, Glen-Gery is a leading brick and stone manufacturer offering the market’s most diverse portfolio of brick colors, sizes, and textures to commercial and residential customers. The company operates 10 manufacturing plants and 10 masonry supply centers throughout the U.S. The acquisition provides Brickworks with an ideal U.S. market entry, capitalizing on Glen-Gery’s established position in its core geographic area.

|

|

| Aquires |

|

|

StonePoint Materials, LLC to acquire VantaCore Partners LP

(November 2018, $205 Million)

StonePoint Materials, in partnership with private equity firm Sun Capital Partners, has entered into a definitive agreement to acquire VantaCore Patners at a valuation of $205 million. VantaCore operates as a leading producer of crushed stone, sand, and gravel for numerous end markets. VantaCore has over 7.6 million tons of annual production as well as several operating companies it has acquired since its founding in 2006.

“The aggregates sector is highly fragmented with numerous M&A targets, and VantaCore has proved its ability to integrate strategic acquisitions,” Aaron Wolfe, managing director at Sun Capital, added in a press release.5

CONSTRUCTION MATERIALS UPDATE

Construction input prices (Figure 5) decreased 1.7 percent in December and are up 3.5 percent on a year-over-year basis, according to an Associated Builders and Contractors (ABC) analysis of data recently released by the US Bureau of Labor Statistics.

AGGREGATES MATERIALS

Industry results in 2018 showed increases in volume compared to 2017 for cement (4.3 percent), crushed stone (4.0 percent), and sand & gravel (6.5 percent). Additionally, ready-mix concrete and asphalt experienced increases in prices when compared to the prior year.

Citations

1. U.S. Federal Government, “Fiscal Year 2020 Budget of the U.S. Government,” https://www.whitehouse.gov/wp-content/uploads/2019/03/budget-fy2020.pdf, accessed March 20, 2019.

2. Eagle Materials, “Eagle Materials Reports Third Quarter Results,” http://ir.eaglematerials.com/news-releases/news-release-details/eagle-materials-reports-third-quarter-results-0, accessed March 19, 2019.

3. US Concrete, “US Concrete Announces Full Year 2018 and Fourth Quarter Results,” http://investorrelations.us-concrete.com/news-releases/news-release-details/us-concrete-announces-full-year-2018-and-fourth-quarter-results, accessed March 20, 2019.

4. Cision PR Newswire, “Glen-Gery Corporation Acquired by Brickworks Limited,” https://www.prnewswire.com/news-releases/glen-gery-corporation-acquired-by-brickworks-limited-300755114.html, accessed March 19, 2019.

5. Business Wire, “Sun Capital Partners Affiliate Partners with StonePoint Materials to Acquire VantaCore Partners,” https://www.businesswire.com/news/home/20181119005375/en/Sun-Capital-Partners-Affiliate-Partners-StonePoint-Materials, accessed March 20, 2019.

Capstone Headwaters is an elite investment banking firm dedicated to serving the corporate finance needs of middle market business owners, investors and creditors. Capstone Headwaters provides merger and acquisition, private placement, corporate restructuring and financial advisory services across 16 industry verticals to meet the lifecycle needs of emerging enterprises. Headquartered in Boston and Denver, Capstone Headwaters has 20 offices in the U.S., UK and Brazil with a global reach that includes more than 300 professionals in 34 countries. For more information, visit www.capstoneheadwaters.com. To discuss any information contained in this report, contact the Capstone Headwaters team: Darin Good, managing director, [email protected], 303-549-5674; Brian Krehbiel, senior vice president, [email protected], 970-215-9572; Crista Gilmore, vice president, [email protected], 303-531-5013.